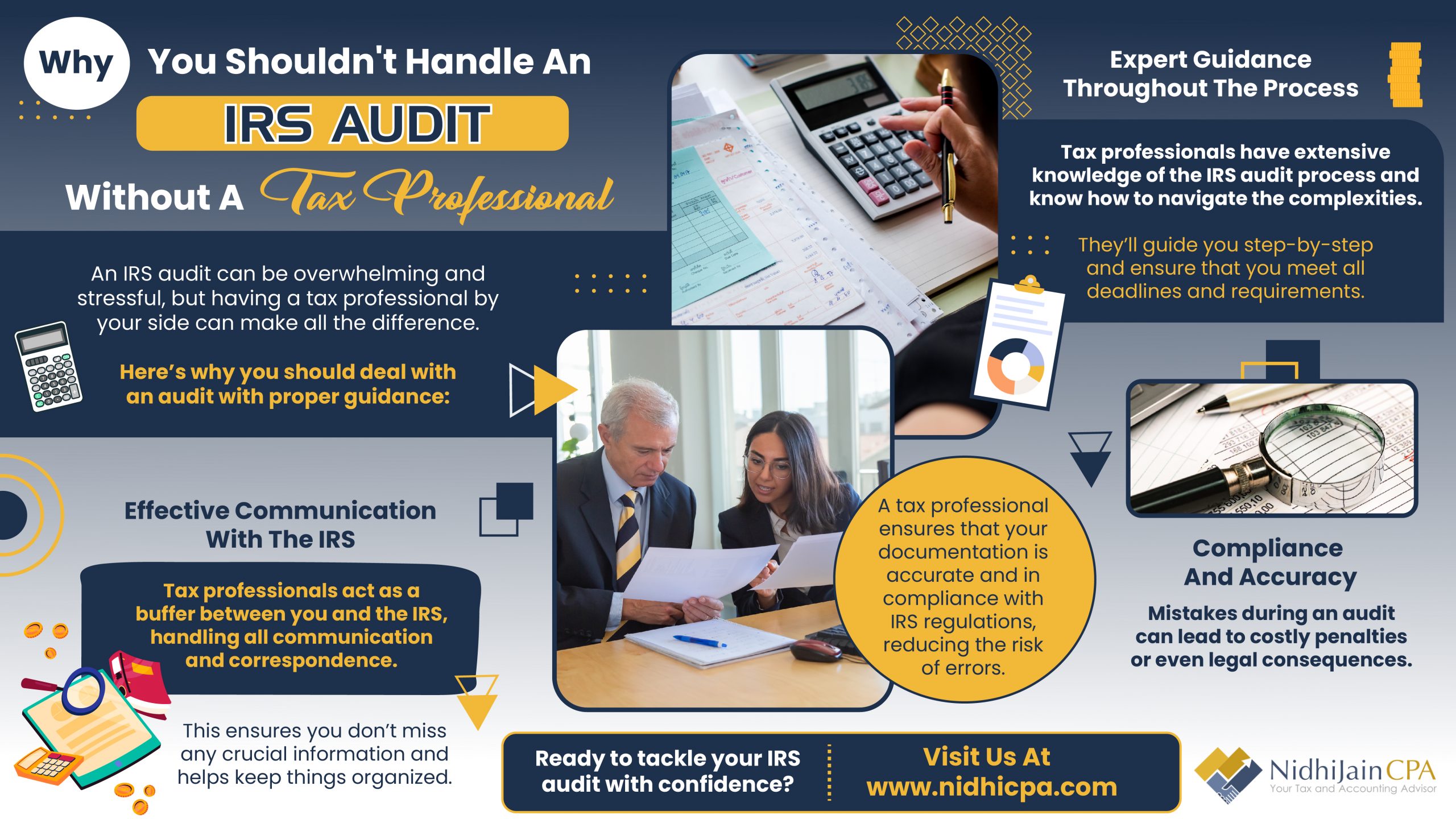

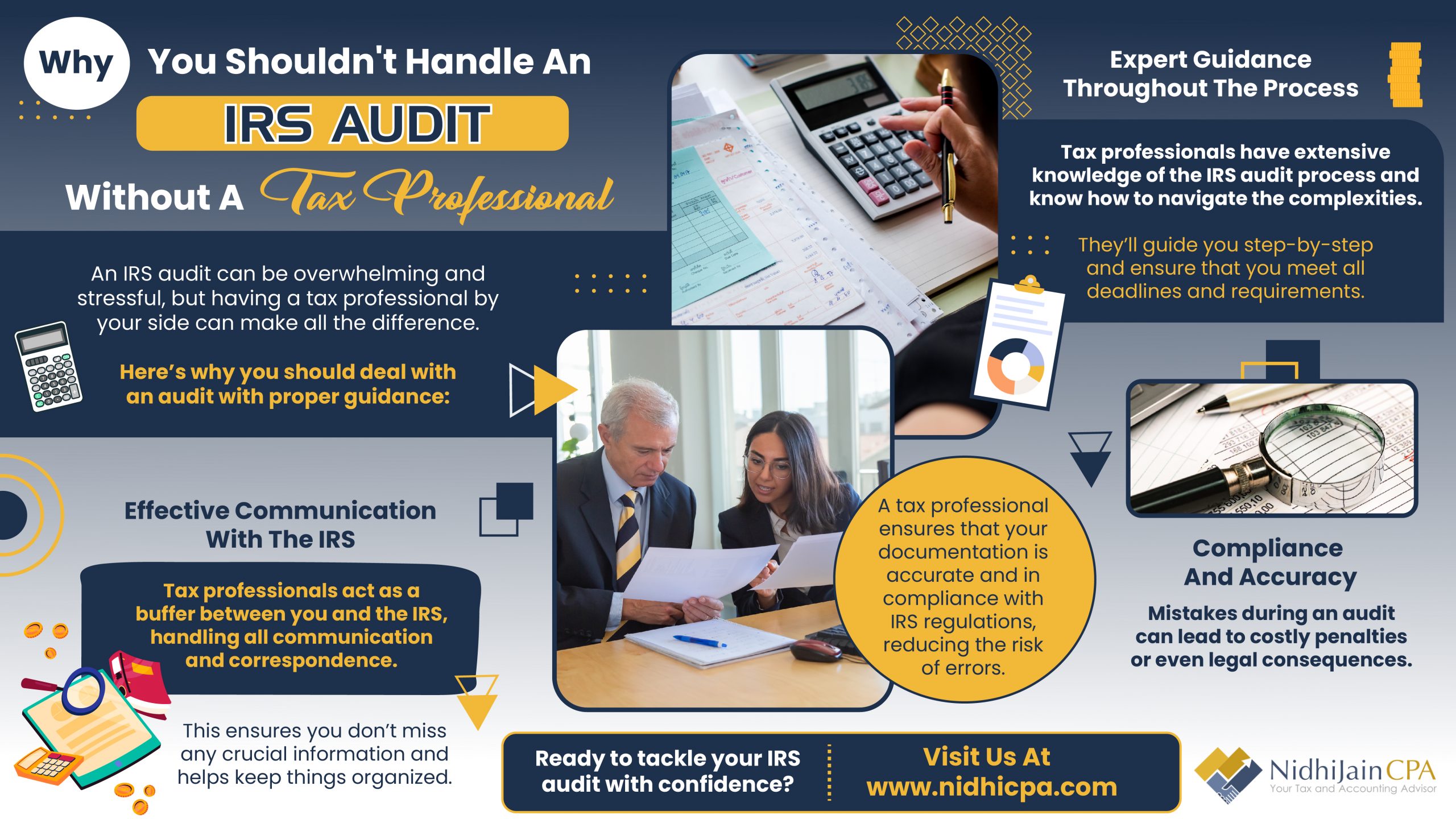

An IRS audit can be overwhelming and stressful, but having a ta professional by your side can make all the difference. Here’s why you should deal with an audit with proper guidance.

An IRS audit can be overwhelming and stressful, but having a ta professional by your side can make all the difference. Here’s why you should deal with an audit with proper guidance.

Tax season can be stressful, and errors in your return can lead to costly penalties or missed deductions. Whether you’re managing business tax filing or handling your personal taxes, certain common mistakes could impact your finances. By understanding these pitfalls, you can take steps to ensure a smoother filing process and maximize your savings. …

Running a small business comes with many financial responsibilities, and taxes can be one of the most significant expenses. However, with the right small business tax strategies, you can legally minimize your tax burden and keep more of your hard-earned profits. Understanding essential deductions, tax credits, and proactive planning can make a big difference in managing your finances effectively. …

Tax-Saving Strategies Every Small Business Owner Should KnowRead More »

As the end of the year approaches, businesses have a crucial opportunity to implement year-end tax planning strategies that maximize deductions and improve financial efficiency. Proper preparation can make a significant difference in reducing taxable income and positioning a business for a strong start in the new year. By working with a tax consultant in San Francisco and maintaining accurate bookkeeping and accounting, business owners can take advantage of available deductions before the tax deadline. …

Year-End Tax Planning Tips to Maximize DeductionsRead More »

CPA, CTC, CA, Master of Commerce (India)

This e-mail and any files transmitted with it are for the sole use of the intended recipient(s) and may contain confidential and privileged information. If you are not the intended recipient(s), please reply to the sender and destroy all copies of the original message. Any unauthorized review, use, disclosure, dissemination, forwarding, printing or copying of this email, and/or any action taken in reliance on the contents of this e-mail is strictly prohibited and may be unlawful.

Nidhi Jain is a CPA and Indian CA providing services in US and India. We serve Bay area including South Bay, Sunnyvale, San Jose, Milpitas, Fremont, East Bay, Trivalley, Pleasanton, Livermore, Dublin and San Ramon. We specialize and have extensive experience to best serve our clients with complex tax situations like: Asset Inheritance and Gift from Foreign countries, Repatriating Money from Foreign countries, FBAR Filing (Foreign Bank Account Reporting), Incorporation of US Entity by International Clients, International Tax reporting and compliance of selling property abroad, Tax Planning and Advisory Service

© 2025 Nidhi Jain CPA. All Rights Reserved