-

Nidhi Jain

Nidhi Jain

Related Blogs

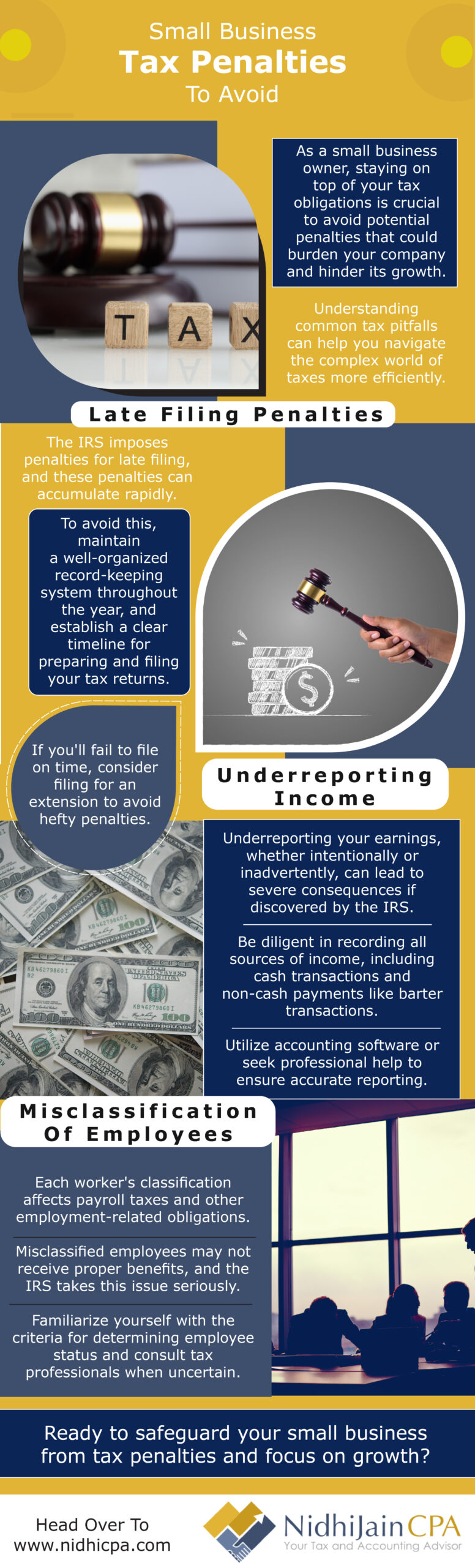

Tax season can be stressful, and errors in your return can lead to costly penalties or missed deductions. Whether you’re managing business tax filing or handling your personal taxes, certain common mistakes could impact your finances. By understanding these pitfalls, you can take steps to ensure a smoother filing process and maximize your savings. …

Running a small business comes with many financial responsibilities, and taxes can be one of the most significant expenses. However, with the right small business tax strategies, you can legally minimize your tax burden and keep more of your hard-earned profits. Understanding essential deductions, tax credits, and proactive planning can make a big difference in managing your finances effectively. …

Tax-Saving Strategies Every Small Business Owner Should KnowRead More »

As the end of the year approaches, businesses have a crucial opportunity to implement year-end tax planning strategies that maximize deductions and improve financial efficiency. Proper preparation can make a significant difference in reducing taxable income and positioning a business for a strong start in the new year. By working with a tax consultant in San Francisco and maintaining accurate bookkeeping and accounting, business owners can take advantage of available deductions before the tax deadline. …

Year-End Tax Planning Tips to Maximize DeductionsRead More »