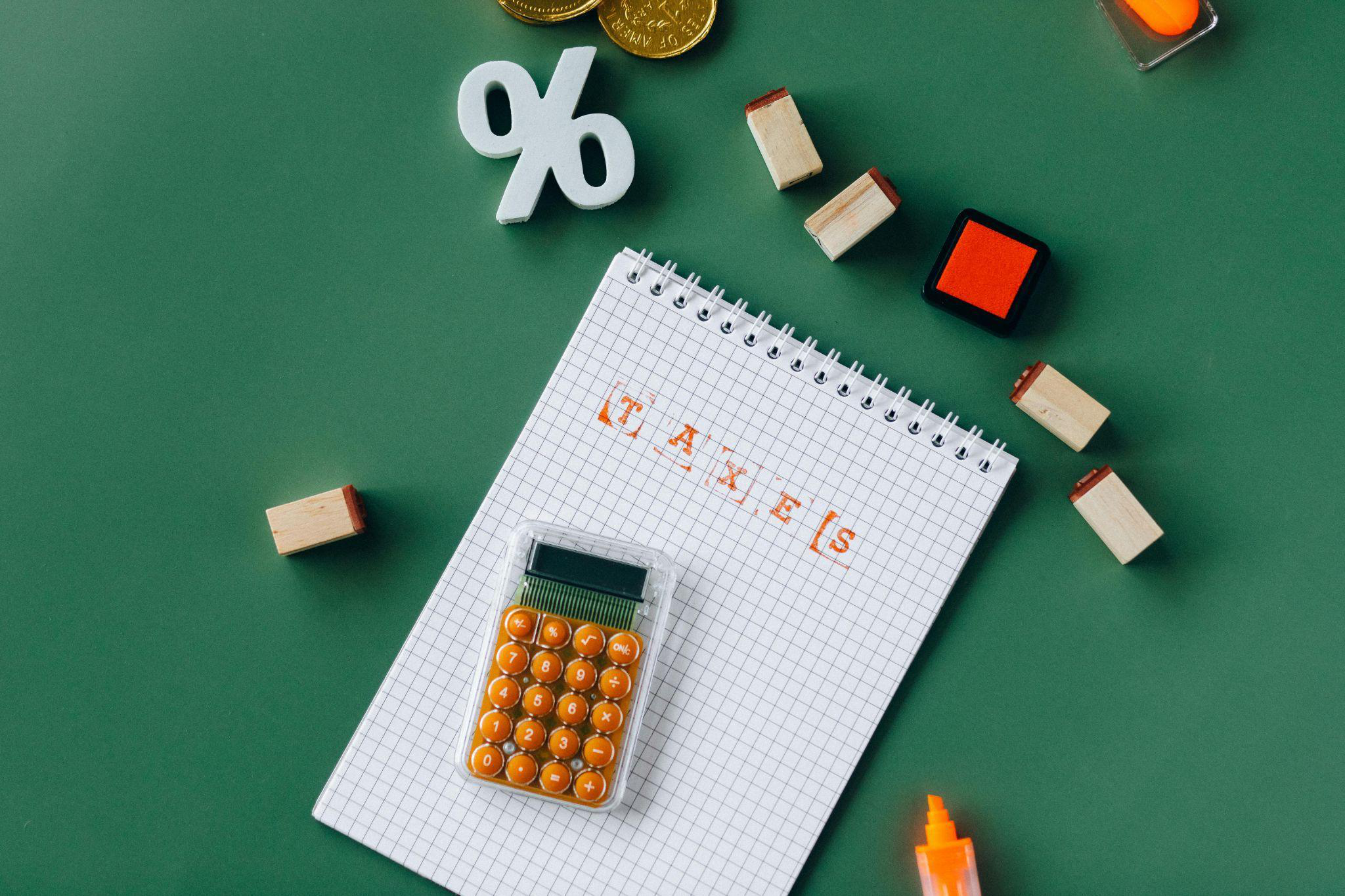

The Alternative Minimum Tax for business owners is a parallel tax system designed to ensure businesses with high income and significant deductions pay their fair share of taxes. While this may sound straightforward, it can introduce unexpected tax obligations. Understanding how it works can help businesses manage their financial planning with greater precision.

What Is the Alternative Minimum Tax (AMT)?

The AMT is a separate tax calculation that applies if a business’s income exceeds a certain threshold after considering specific adjustments. Unlike the regular tax system, which allows a range of deductions and credits, the AMT eliminates some of these, potentially increasing taxable income. Businesses are required to calculate their tax liability under both the regular tax system and the AMT, paying whichever amount is higher.

Who Is Affected by the AMT?

The AMT system no longer applies to corporations following the Tax Cuts and Jobs Act (TCJA) of 2017, which eliminated the corporate AMT. However, AMT can still impact individual business owners (e.g., sole proprietors, partners in pass-through entities). It applies if their income is high and they have significant deductions.

Corporate Tax Rate (2025)

The law created a single corporate tax rate of 21% and repealed the corporate AMT. Proponents of lowering the corporate tax rate claimed it decreased the motivation for corporate inversions. In these situations, companies move their tax base to jurisdictions with low or no taxes, frequently by merging with foreign companies.

Step-by-Step Guide to Understanding the AMT

1. Determine Regular Taxable Income

Start by calculating taxable income under the regular tax system. Use all applicable deductions and credits.

2. Adjust for AMT Preferences

Add back items not deductible under the AMT rules, such as accelerated depreciation, certain tax-exempt interest, and incentive stock options.

3. Calculate AMTI (Alternative Minimum Taxable Income)

Adjust the regular taxable income to reflect AMT rules, arriving at the AMTI.

4. Apply the AMT Exemption

Reduce the AMTI by the applicable AMT exemption amount, which varies based on the type of entity and income level.

5. Calculate the AMT

Multiply the remaining amount by the AMT rate, which is typically 26% or 28%.

6. Compare Tax Liabilities

Calculate the tax due under the regular tax system and the AMT. The higher amount becomes the business’s tax liability.

Strategies to Manage AMT Liability

1. Plan for Depreciation

Use straight-line depreciation instead of accelerated methods to minimize AMT adjustments.

2. Track Tax Credits

Review carryforward credits to offset future AMT liability.

3. Monitor AMT Triggers

Identify deductions and credits likely to be disallowed under AMT rules and adjust financial plans accordingly.

4. Consult a Professional

Engaging a knowledgeable tax consultant can help navigate complex AMT requirements.

Professional Tax Expertise by Nidhi Jain CPA

For businesses affected by the Alternative Minimum Tax for business owners, partnering with a trusted tax advisor is invaluable. Nidhi Jain CPA, a leading CPA in San Jose, specializes in helping businesses manage their tax obligations effectively.

For more tax management tips and insights on how to navigate complex tax issues like the AMT, please visit our blog! We offer a wealth of resources, from in-depth articles on the latest tax laws to practical advice on minimizing tax liabilities for business owners.