Interest rates play a vital role in the financial world, influencing borrowing costs, investment returns, and economic growth. However, they are not set in stone and can fluctuate over time, introducing an element of uncertainty known as interest rate risk. Understanding and effectively managing interest rate risk is essential as an investor, borrower, or even a saver.

In this blog post, we will discover the world of interest rates, explore interest rate risk, and provide actionable strategies to mitigate its impact.

What is Interest Rate Risk?

Interest rate risk refers to the potential for the value of an investment or cash flow to be affected by changes in interest rates. This risk arises due to the inverse relationship between interest rates and the prices of fixed-income securities, such as bonds. When interest rates increase, the value of existing fixed-rate investments tends to decline, while falling interest rates can lead to increased value.

1. Managing Interest Rate Risk

Interest rate risk is an inherent aspect of the financial landscape, and managing it effectively is crucial for individuals and businesses. By diversifying your portfolio, understanding bond duration, exploring floating-rate securities, utilizing hedging instruments, and staying informed, you can mitigate the impact of interest rate fluctuations and make more informed financial decisions.

2. Diversify Your Portfolio

A well-diversified investment portfolio is one of the key pillars of risk management. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of interest rate changes on your overall portfolio. For example, if you hold both stocks and bonds, the potential decline in bond prices due to rising interest rates may be offset by gains in the equity market.

3. Understand Bond Duration

It is a measure of the sensitivity of a bond’s price to changes in interest rates. Bonds with longer durations are more sensitive to interest rate movements. If you are concerned about interest rate risk, consider investing in bonds with shorter durations, as they tend to be less affected by interest rate fluctuations.

4. Consider Floating-Rate Securities

Floating-rate securities, such as adjustable-rate mortgages or floating-rate bonds, have interest payments that adjust periodically based on prevailing market rates. These investments provide a natural hedge against interest rate risk as the interest payments increase when rates rise, protecting the investor from potential losses.

5. Utilize Interest Rate Hedging Instruments

Financial instruments like interest rate swaps, futures, and options can be used to hedge against interest rate risk. These tools allow you to lock in a fixed interest rate or protect against adverse rate movements. However, it is essential to understand the mechanics and potential risks associated with these instruments before employing them.

6. Stay Informed

Keep an eye on economic indicators and central bank announcements, as they can provide insights into potential interest rate changes. You can make important investment or borrowing decisions by staying informed about macroeconomic trends. Financial news outlets, economic reports, and professional advice can be valuable resources.

To Sum Up

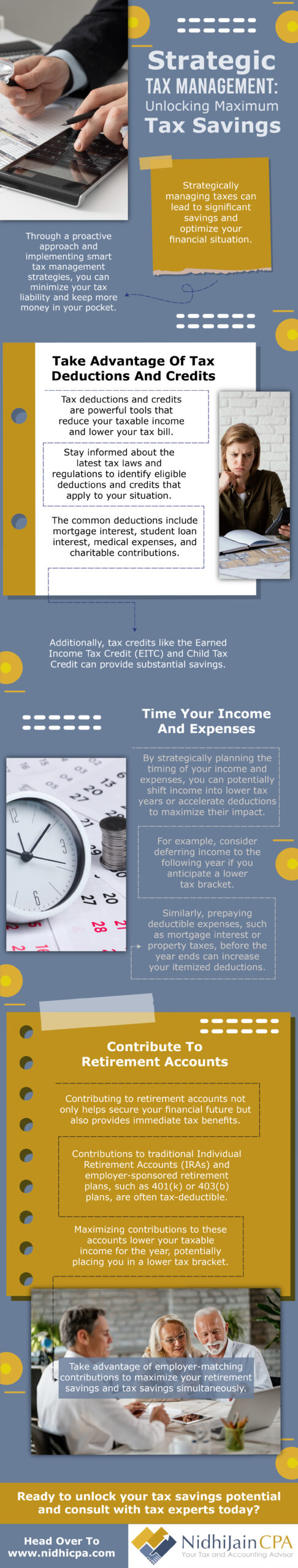

When navigating the complex world of taxes and financial planning, having a reliable and knowledgeable Certified Public Accountant (CPA) is essential. Look no further than Nidhi Jain, CPA for all your accounting and tax needs. With Nidhi Jain, you can trust that your financial well-being is in capable hands. Whether you need assistance with tax planning, financial statement preparation, or business consulting, Nidhi Jain, the best CPA in San Jose has the knowledge and skills to guide you toward success.