Entrepreneurship is an exhilarating journey filled with opportunities, innovation, and growth. As an entrepreneur, you’re at the helm of your business, steering it toward success. However, amid the dynamic world of entrepreneurship, effective financial management is essential. Budgeting and investment play a crucial role in securing your financial future.

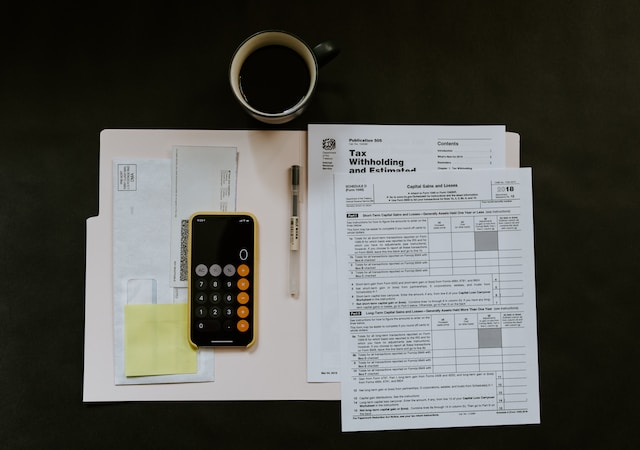

Before we dive into budgeting and investment tips, it’s important to acknowledge the vital role of a tax accountant in the Bay Area. These professionals are well-versed in the region’s intricate tax laws and can provide valuable insights to help you make informed financial decisions.

Budgeting for Financial Clarity

Budgeting isn’t about restriction; it’s about clarity. It’s the tool that lets you know where your money is going and how it aligns with your goals. Here are some tips to make budgeting work for your entrepreneurial journey:

1. Define Your Financial Goals

Start by setting clear financial goals for your business. Whether it’s expanding your product line, increasing revenue, or reducing costs, having a target in mind will guide your budget.

2. Track All Expenses

Maintain a detailed record of all your business expenses. Accurate tracking ensures you’re aware of where your money is being spent.

3. Categorize Your Spending

Categorize your expenses to understand which areas are consuming the most resources. This insight can help you identify areas for potential cost reduction or optimization.

4. Monitor Cash Flow

Cash flow is the lifeblood of your business. It’s important to track your cash flow to ensure you have enough liquidity to cover expenses, invest in growth, and weather unexpected challenges.

Investment Strategies for Growth

Budgeting sets the stage, but investment strategies are the actors that drive growth. Here are some investment tips for entrepreneurs:

1. Diversify Your Investments

Diversification is a classic strategy to reduce risk. Consider investing in different asset classes to minimize exposure to a single market’s fluctuations.

2. Explore Tax-Efficient Investments

Certain investments come with tax benefits. For example, retirement accounts like Solo 401(k)s or Simplified Employee Pension IRAs (SEP-IRAs) offer tax deferral advantages while securing your financial future.

3. Consider Long-Term Goals

Investing is a long-term game. Don’t let short-term market fluctuations sway your decisions. Focus on your long-term financial goals and stay committed to your investment strategy.

4. Seek Professional Guidance

Navigating the investment landscape can be complex. Consider hiring a financial advisor or an Indian CPA for payroll services in Bay Area to make informed investment decisions that align with your business objectives.

Financial empowerment is within your reach. Effective budgeting and investment strategies can transform your business’s financial health. As you embrace these practices, remember that you’re not alone in this journey.

At Nidhi Jain CPA, we understand the unique financial needs of entrepreneurs. Our team of experts, including personal accountant in Dublin and Indian CPAs, is dedicated to your financial success.

Let’s work together to empower your financial future. Reach out to us today and discover how our financial expertise can elevate your entrepreneurial journey.