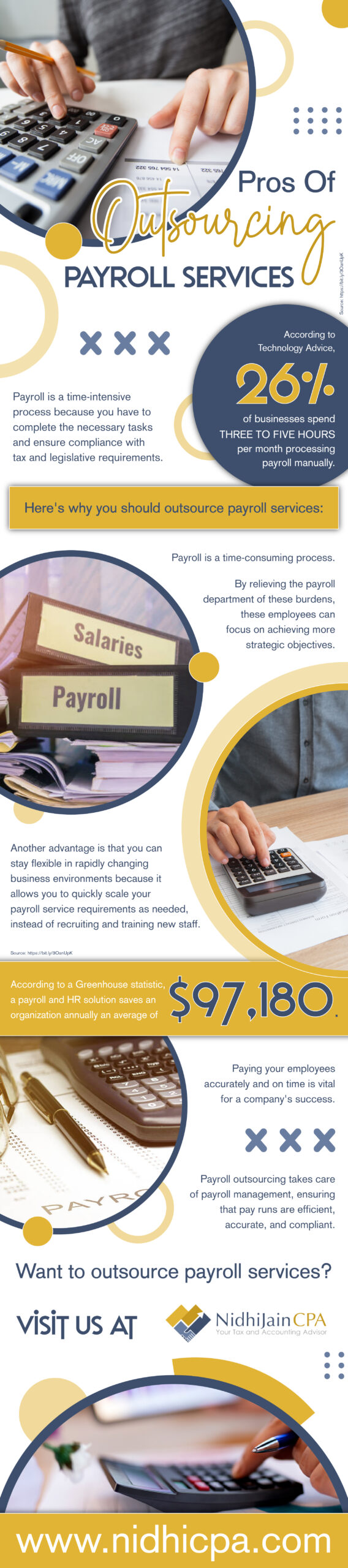

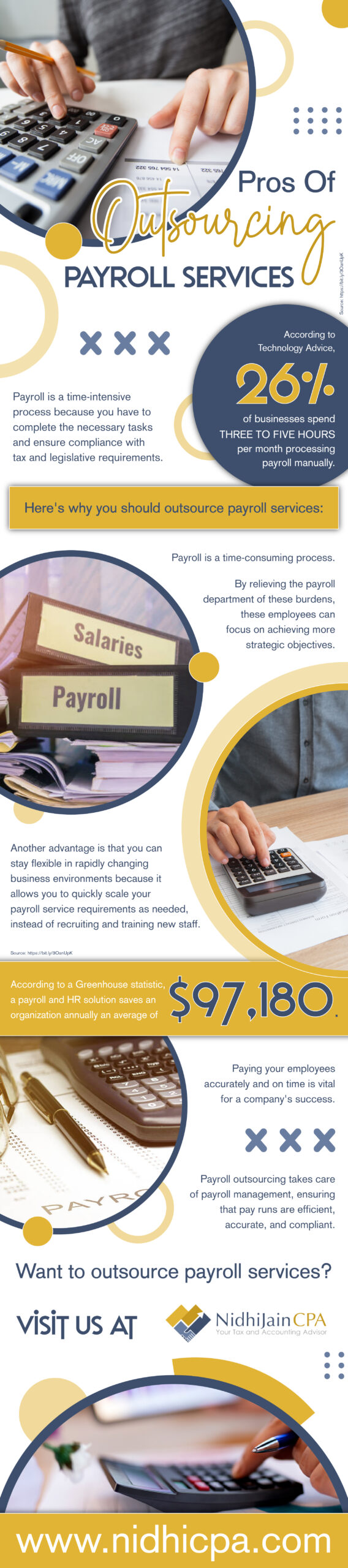

Payroll is a time-intensive process because you have to complete the necessary tasks and ensure compliance with tax and legislative requirements.

Payroll is a time-intensive process because you have to complete the necessary tasks and ensure compliance with tax and legislative requirements.

Running a small business comes with many financial responsibilities, and taxes can be one of the most significant expenses. However, with the right small business tax strategies, you can legally minimize your tax burden and keep more of your hard-earned profits. Understanding essential deductions, tax credits, and proactive planning can make a big difference in managing your finances effectively. …

Tax-Saving Strategies Every Small Business Owner Should KnowRead More »

As the end of the year approaches, businesses have a crucial opportunity to implement year-end tax planning strategies that maximize deductions and improve financial efficiency. Proper preparation can make a significant difference in reducing taxable income and positioning a business for a strong start in the new year. By working with a tax consultant in San Francisco and maintaining accurate bookkeeping and accounting, business owners can take advantage of available deductions before the tax deadline. …

Year-End Tax Planning Tips to Maximize DeductionsRead More »

Facing tax issues with the IRS can be stressful and overwhelming, whether it’s an audit, unpaid taxes, or a dispute over deductions. The complexities of tax laws and regulations make it difficult to handle these problems alone. This is where a CPA plays a crucial role in IRS problem resolution, offering guidance, expertise, and strategies to address tax challenges effectively. …

CPA, CTC, CA, Master of Commerce (India)

This e-mail and any files transmitted with it are for the sole use of the intended recipient(s) and may contain confidential and privileged information. If you are not the intended recipient(s), please reply to the sender and destroy all copies of the original message. Any unauthorized review, use, disclosure, dissemination, forwarding, printing or copying of this email, and/or any action taken in reliance on the contents of this e-mail is strictly prohibited and may be unlawful.

Nidhi Jain is a CPA and Indian CA providing services in US and India. We serve Bay area including South Bay, Sunnyvale, San Jose, Milpitas, Fremont, East Bay, Trivalley, Pleasanton, Livermore, Dublin and San Ramon. We specialize and have extensive experience to best serve our clients with complex tax situations like: Asset Inheritance and Gift from Foreign countries, Repatriating Money from Foreign countries, FBAR Filing (Foreign Bank Account Reporting), Incorporation of US Entity by International Clients, International Tax reporting and compliance of selling property abroad, Tax Planning and Advisory Service

© 2025 Nidhi Jain CPA. All Rights Reserved